Lifestyle & Fashion

How To Lead The Ideal Life Without Becoming As Broke As The Joneses

Editorial Staff

Your Values Should Be A Driving Force Behind Money Decisions, Financial Planner Says

By Brad Berger

It’s human to feel envious when a neighbor drives up in an expensive new car or posts photos online of a two-week European vacation.

But when you let that envy drive your decisions about spending money, you could be headed for financial trouble – the same kind of trouble the seemingly affluent neighbor already may be facing.

“Too many people get caught up in accumulating things and projecting an image of success,” says Brad Berger, author of the book “Stop Trying to Keep Up With the Joneses – They’re Broke Anyway” (www.LiveYourIdealLife.com).

“Often they make decisions based on how other people lead their lives and the image those people project. But in many cases, the people you think have money because of the cars they drive, the homes they live in or the vacations they take, may be barely scraping by.”

Such people create an illusion of wealth because they live extravagantly today, but lack any coherent plan for tomorrow, says Berger, who also is a managing partner and owner of Cornerstone Financial Strategies in Tacoma, Wash.

They let someone else’s values, rather than theirs, determine their financial choices.

“The secret to success is determining what you – not someone else – want to achieve and then figuring out what it’s going to take to achieve that,” Berger says. “Living in alignment with your values doesn’t automatically bring on the good life, but it becomes the foundation that guides future decisions about what you want to pursue.”

Berger says people’s needs and concerns are too individual for one-size-fits-all financial advice. Instead, he says, you should strive to live your ideal life through a financial planning process that:

• Aligns your financial choices with your goals and values. “It is important to understand what drives your decisions,” Berger says. “I regularly double check to make sure any action I am about to take is in alignment with what is important to me. In other words, I ask whether my action is in keeping with my values or takes me further away from them.”

• Gets your entire financial house in order. Not only do you want that financial house in order, you want to keep it that way forever. That’s easy to say, but more difficult to do. Part of this means focusing on your values and setting goals based on them. But it also involves planning and figuring out what the best investment strategies would be. And then it’s important to regularly monitor what you’ve done to see if adjustments need to be made.

• Gives you confidence. You want to feel that, no matter what happens in the markets, the economy or the world, you will be on track toward your goals. Financial planning isn’t just about investing in the stock market, Berger says. You also need to manage risks, plan for retirement, develop a comprehensive tax plan and put in place a plan to take care of your family after you are gone.

• Frees up mental and physical space and time. Ideally, your plan will give you the peace of mind to stop focusing so much on money and what it can buy, and instead home in on the things in your life that are more important. “I have learned that the accumulation of shiny objects does not lead to happiness,” Berger says.

Even when you finish setting up your financial plan, you aren’t finished.

“Financial planning is not a destination; it’s a journey,” Berger says. “I’m constantly monitoring and tweaking my own plan. As I accomplish goals, I regularly add new ones. I adjust to changes in the market and to estate laws and taxes.

“The plan evolves as my family needs change. There is always some way to improve it.”

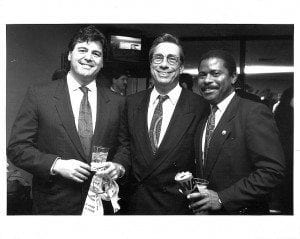

About Brad Berger

Brad Berger, a managing partner and owner of Cornerstone Financial Strategies LLC (www.LiveYourIdealLife.com) in Tacoma, Wash., is a CERTIFIED FINANCIAL PLANNER™ Professional with more than two decades of experience. He also is the author of the book “Stop Trying to Keep Up With the Joneses – They’re Broke Anyway: A Financial Planner’s Guide to Living Your Ideal Life.” He is a graduate of the United States Military Academy at West Point and served as a Scout Platoon Leader in Berlin, Germany, during the fall of the Berlin Wall.

Securities offered through LPL Financial, Member FINRA/SIPC. Financial Planning and Investment Advice offered through Financial Advocates Investment Management, a Registered Investment Advisor, DBA Cornerstone Financial Strategies LLC and a separate entity from LPL Financial.