Greece is in danger of default and the United States is on the hook for it. They have guaranteed the debt on the basis that the European Union would help Greece out of default. With the EU and the Euro in danger of extinction in the next year that is not looking likely. EU looked to China to for support and was declined sending the markets spiraling. Looking at the numbers it is not difficult to see why China would not want to become involved.

We are seeing the death throes of a dying system that can no longer sustain itself. There are only so many bubbles that can be blown up and so many people who can be fleeced before it implodes. Greece, Spain, Ireland, and other countries are quickly finding out that they have become slaves to the banks with massive debts that they cannot hope to pay with the current revenues. Increased revenues would have to come in the form of increased taxes which the people will not tolerate, or they will default on their obligations which will send markets crashing.

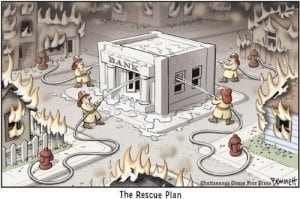

Since the United States has backed much of this debt that means we would be the ones being defaulted on. Also, the largest banking institutions, the ones deemed “too big to fail” have significant exposure in Europe. If Greece defaults the rest of the European Union and the Euro will continue to destabilize causing markets to crash and affect their positions.

Other factors are also contributing to the potential risk of a double dip recession. If the President and Congress fail to address these issues as they have been then the US is most certainly heading for another Recession.