A general overview of college financial aid options

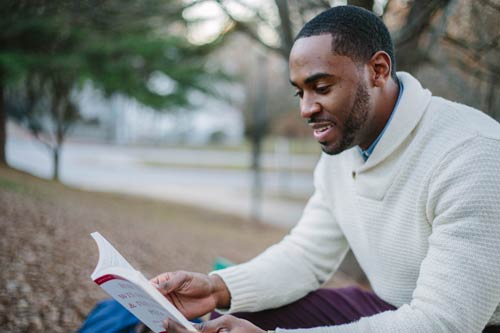

A week before the fall quarter started, I was in my favorite indie coffee shop near campus, spending $3.50 on a small cup of chai tea. I wondered how much money I had in my bank account, remembering that school would start soon which would mean all my money would be gone.

Back home, I panicked. My monthly paycheck would barely cover tuition, leaving me only $10. At the same time, tuition has been rising by about $300 per term.

Thanks to college financial aid, grants from my school covered the bulk of last year’s fee. This time, my Expected Family Contribution, an estimate of my parents’ and my own ability to cover my education expenses, was deemed too high (it’s the same as it’s always been, but they lowered the cap), which means I have now officially joined the ranks of the millions of Americans who are in debt.

College financial aid is not a sexy topic, and there is a lot of information out there that can easily lead to an overload. Fear not. College News is breaking it down for you, based on research and an interview with Mark Kantrowitz, Publisher of Fastweb.com and FinAid.org.

THE BASICS

“Financial aid comes from different sources, including the federal government, the state government, the university and private donors,” Kantrowitz said about college financial aid.

“As far as applying for most forms of financial aid, you submit the Free Application for Federal Student Aid (FAFSA),” continued Kantrowitz. In addition, colleges may also have their own financial aid forms that need to be filled-out.

“After you fill out the forms, financial aid is determined based on need and merit,” he added. “Need-based aid looks at your money assets and your Expected Family Contribution (EFC). If you are a dependent, the EFC depends on your parents’ income from the previous tax year.

“This EFC is subtracted from your total cost of attendance to equal what you owe for your education. Then you receive a financial aid package, which may include aid from various sources. Types of financial aid include scholarships, grants, loans and work-study.”

SCHOLARSHIPS AND GRANTS

Both scholarships and grants are types of college financial aid that give money which doesn’t need to be repaid. Grants are desirable because they are largely need-based, as determined from the information you provide in the FAFSA form, and eligibility depends on the type of grant.

There are three basic types: federal, state, and institutional grants. Federal grants include the Pell Grant and the Academic Competitiveness Grant.

Scholarships are types of college financial aid awarded mostly based on merit. They can be quite competitive. To apply, you may have to write an essay, submit a portfolio or win a competition.

There are national scholarships that offer huge awards, but obviously, those are most competitive, since there are thousands of eager undergraduates applying and only one who wins. The good news is that there are many scholarships out there that students do not know about.

“Searching for scholarships on a match website like Fastweb.com is a good strategy. It takes very little time to search and only half an hour to complete the profile. A typical student can get from 50 to 100 matching scholarship results,” Kantrowitz said.

The next thing to do to find college financial aid is a little research beyond these mass-generating websites. Students often forget about their own backyard. Many city, county and state governments have scholarship competitions, as do your local businesses. On Google, type your location plus “scholarship”. Also, ask your financial aid counselor, who is usually very aware of local resources.

Many scholarships also target minorities, like the Hispanic Scholarship Fund. Many of you may not think that you’re a minority, but the other day, I overheard a story of a white student who wrote an essay on how he was a minority in his high school, where the majority was black and Hispanic students. If you can legitimately write about it, then go for it.

Lastly, check your school’s department website and ask your instructors for additional leads. However, make sure that the scholarship you chose to apply for is reliable.

“If you have to pay money to get money, it’s probably a scam,” Kantrowitz said.

LOANS

College financial aid also includes loans, which can be federal or private. The good thing is that loans help establish your credit history. The bad thing is that you will have to pay the money back after graduation and missing a payment will put a dent in your credit report.

Government student loans, such as the Stafford or Perkins loans, offer lower interest rates than private loans, according to Kantrowitz. There are loans that are subsidized, meaning that you do not have to pay interest after graduation, and unsubsidized, where the interest accrues throughout your years in school.

Private loans are generally offered by banks, credit unions and other private lending institutions such as Sallie Mae. It is a good idea to talk to your local bank or credit union (to find a credit union near you, go to StudentChoice.org).

When it comes to financial aid, it is important to understand, Kantrowitz explained, that if you receive a private scholarship, federal law mandates that the university will reduce the loans in your college financial aid package before it reduces any other part of your financial aid. However, colleges will usually reduce their own financial aid first before federal financial aid because they find it more beneficial financially.

MORE TIPS

Work-study is also a good way to earn money for college financial aid. Most universities will offer less than 15 hours a week for work-study, so you can earn money for college, learn time management skills, and sometimes even get real work experience in your own field of study, as some work-study jobs can be relevant to a degree.

There are also awards such as Americorp or Teach for America that cover education expenses in return for a period of community service.

Another type of college financial aid is education tax benefits. “There are different types, but the best type is the Hope Scholarship Tax Credit,” Kantrowitz said, “which offers tax relief based on how much you pay annually for tuition and books.” Your parents will have to file for it in the federal income tax return. People often overlook this option since you have to file for it after the fact rather than in advance, as with some of the other options.

“The easiest way to save money on education is to attend an in-state university,” Kantrowitz added. Many public colleges offer an equivalently good education to private institutions. It’s not always the more expensive colleges that are the best, and you don’t necessarily need to graduate from an expensive university to get a good job.

Kantrowitz also recommends saving money by working in the summer, or by taking summer courses that will allow you to graduate sooner.

Finally, in an ideal world, students would graduate school and enter the working world with no debt at all.

“Students who graduate with no debt are two times as likely to go on to graduate school,” Kantrowitz said. “Debt can also delay marriage and other important milestones, so your total debt at graduation should not be more than your starting annual salary.”

For many of us, that’s not always possible. You should take out loans as college financial aid only when there are no other options available.