How to make student loans less of a burden by consolidating

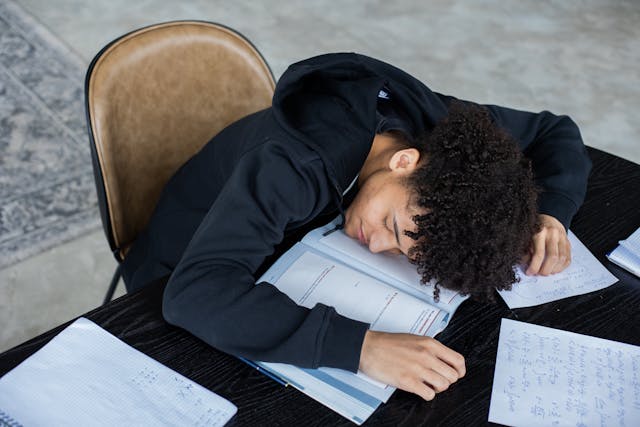

Once the graduation caps are plucked off the auditorium’s floor, your final grades posted, your parents waved goodbye from the airport, and you begin the long, arduous search for employment, you may feel like you finally entered the realm of the elusive time termed adulthood. You are finally done with college.

Unfortunately, college isn’t done with you.

This is because this day was expensive – very expensive. For 60 percent of graduating students, the excitement of being through with the days of library all-nighters are quickly replaced with the reality of their student loan payments. An option a lot of students pursue is consolidating student loans.

When you borrowed money to attend college, you most likely took out several loans from one lender, if not several. Consolidating student loans means that you will take all of these separate loans and combine them into a single loan with a single interest rate, providing the borrower with one combined payment every month and a longer repayment period, sometimes reducing the overall monthly cost to the borrower.

Mark Kantrowitz, publisher of FinAid.org and FastWeb, cautions against this method and challenges the idea that consolidating student loans leads to reducing your overall debt load.

“Some people incorrectly believe that consolidating student loans saves you money,” he said. “The main benefit at this point-in-time is that you will have a single monthly payment.”

The reason for this when consolidating federal student loans is that while your monthly payments might be dropping slightly, the new interest rate is the weighted average of all of the individual interest rates pre-consolidation rounded up to the next 1/8 of a point. Your average 6.8 percent interest rate just jumped to 6.875 percent and your repayment period went from being 10 years to 20.

Consolidating student loans usually includes this extended repayment period – which leads some to believe that they are saving money when they see their monthly payment decrease. Because of this extended repayment period, however, your loan is allowed to accrue more interest – a 10-year repayment turned to a 20-year repayment period means that you are paying roughly 30 percent less every month, but are paying double the amount of interest throughout the life of the loan.

“This is only a good option if your only other option is to default,” said Kantrowitz.

So when does consolidating student loans save you money? It most commonly happens with private loans. If, for the previous three to four years, you have been building up a credit history with on-time credit card, rent, and student loan payments, and you have a stable income, you can convince some lenders, when consolidating private student loans, to give you a lower interest rate. This is one of the few circumstances where a borrower can actually save money through consolidation, although, as Kantrowitz concedes, it won’t be that much.

There is, however, another advantage to consolidating student loans. “Most students get their private student loan with cosigner and if the lender does not have a cosigner release option, you can effectively release your cosigner from their obligation,” said Kantrowitz.

Consolidating student loans without a cosigner, however, can be just as difficult as getting the original private loan. Just like the original loans, consolidating student loans is dependent upon your credit score and ability to pay it back. The problem? Every time you took out one of those loans during school your credit score went down, as your credit score does whenever you take out a loan as your debt-to-income ratio gets wider. In other words, unless you have been actively building your credit throughout college, you are in a worse credit position than when you started college.

In terms of consolidating student loans, you should be extra cautious, just as you should be with any loan. What are the new repayment terms? The new interest rate and fees? The new monthly payment? Typically what one will see when consolidating student loans is a longer repayment period, a slight bump in the interest rate, but a lower monthly payment. While the lower monthly payment may be attractive, you will always be paying substantially more in the long run when consolidating student loans. If you are able to make the monthly payments as they are now, you will be free of the debt sooner with more money to your name. Your retired self with thank you.