An accident can mean financial ruin if you do not have sufficient money in the bank to meet the expense of setting things right. Most people do not have this amount of money in the bank, but insurance products are the answer to this dilemma. We will explain what insurance is and how you can get into a career in insurance below.

Insurance Basics

People cannot reduce risk to a non-existent level. To live with the amount of risk that we have to contend with, we must purchase insurance.

How does Insurance Work?

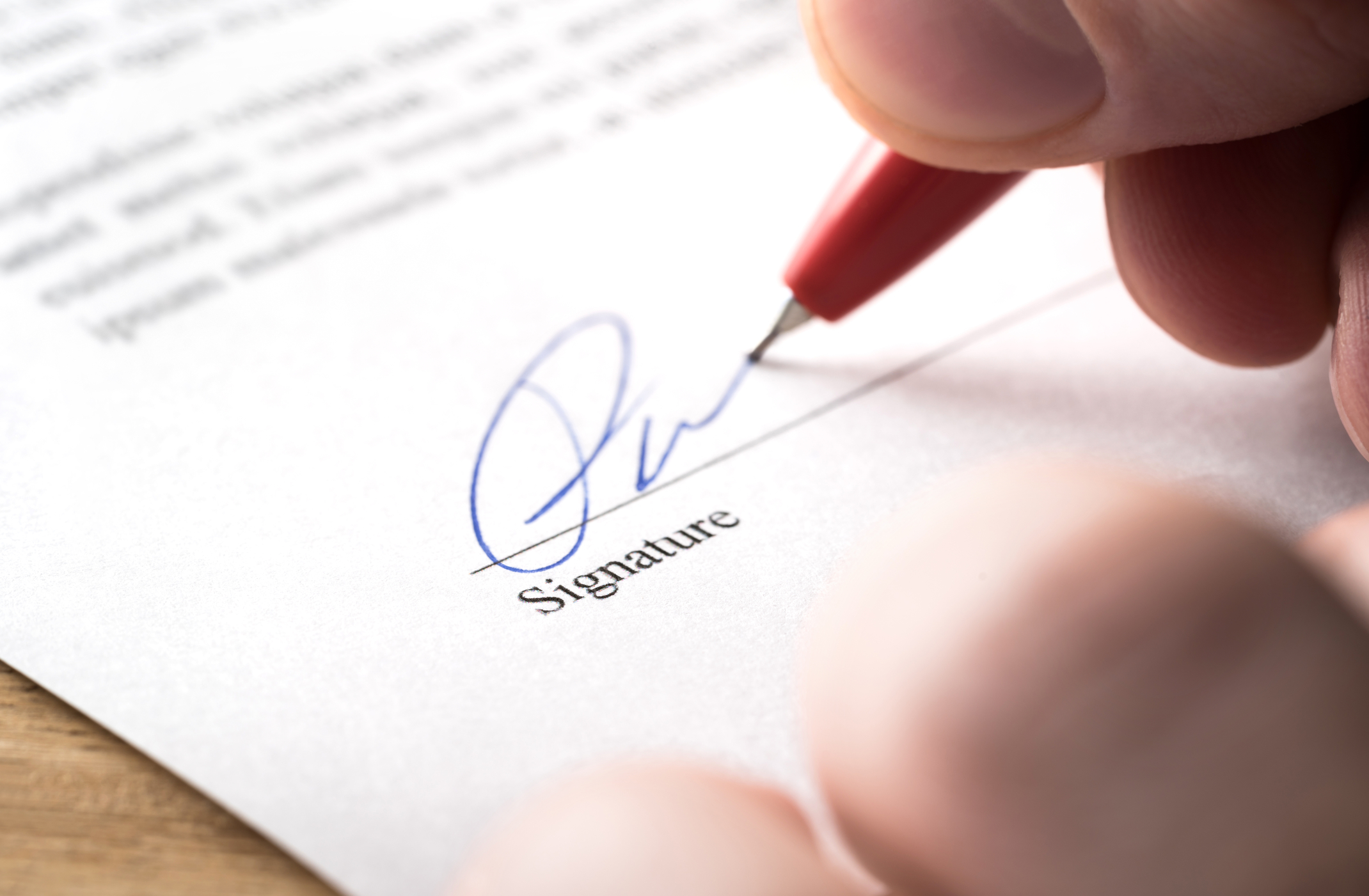

When you purchase an insurance policy, the first thing that an insurer will want to know is how much risk you bring to the company. The risk is how likely you will be to need to file a claim for your insurance coverage. From your level of risk, the insurance agent determines how much you need to pay for your insurance coverage. This may be paid in a monthly, quarterly, semi-annual, or annual payment that is known as a “premium.” If you fail to make these payments throughout the policy’s term, your insurance coverage will lapse.

The insurance agent sets the limits for the amount of money the company will pay for a claim. Before the insurance company pays this amount, the policyholder must pay the deductible. This is the amount the insurance agent sets for the policyholder to pay before the insurance company pays the amount it is obligated to pay.

Tips on a Career in Insurance

Become an Intern at an Insurance Company

Some insurance companies require you to have experience in the insurance industry to qualify as an entry-level insurance agent. You can become an intern, or you may apply as an entry-level sales representative or an administrative assistant to get this experience.

Earn Your Degree

Insurance careers require you to take courses in accounting, marketing, mathematics, finance, and business. A bachelor’s degree will be enough for most careers in insurance, but if you want to reach the highest levels, you will need a master’s degree.

Earn a Certificate in Your Desired Position

A certificate in your desired position will enhance your resume. Certificates demonstrate to executives at insurance companies that you are eager to further your education and increase the skills you have in this area. You can find online or in-person classes in insurance law, risk management, statistics, and accounting.

Join Networking Groups

Networking is a great way to learn about job openings in insurance and about who is currently hiring. It would be a good idea to join a professional insurance organization. This will help you get to know people in the industry, and most importantly, they will get to know you. Getting to know people currently in the industry that you want to be in will help you learn the trends that are occurring in the industry. You can also learn how to do the job effectively and discover many helpful tips. This is also the place where you can find a mentor so that you can have someone to advise you on the industry.

Learn About the Insurance Companies You Would Like to Join

Each insurance company has its expectations as to the education and experience they want their employees to have before they hire them. A good plan is to research insurance companies that interest you and learn which qualifications you need to work for them. Then, you can get those qualifications. Doing so also teaches you the terminology of the industry and the current trends, and this will aid you when it comes time for an interview.

Different Kinds of Insurance Routes

Umbrella Insurance

If you own a home, you have homeowners’ insurance, and if you rent, you may have renters’ insurance. Because most states require that all motorists have auto insurance, you undoubtedly have an auto insurance policy. These policies all have limits attached to the amount of money your insurance company will pay if you are determined to be at fault when someone is injured.

Is it worth It?

For example, your homeowners’ liability insurance may provide $300,000 for someone injured on your property. If this person’s medical bills amount to more than $300,000, you would be responsible for paying the difference, and it may be $100,000 or more. An umbrella insurance policy increases the amount paid for the claim.

Your homeowners’ insurance policy will pay $300,000, and your umbrella insurance policy will pay the remainder.

Long-Term Care Insurance

The Department of Health and Human Services stated that 65-year-old adults have a 70% chance of needing long-term care at some point in their lives. Long-term care insurance covers several expenses, including stays in nursing homes, adult day care and in-home care.

Author Bio: Written by Taylor McKnight, Author for Generali Global Assistance

SEE ALSO: Mapping Your Future: Top States That Support Sustainable Careers Amidst AI Growth